AKE Credit Risk Model - Probable Maximum Loss

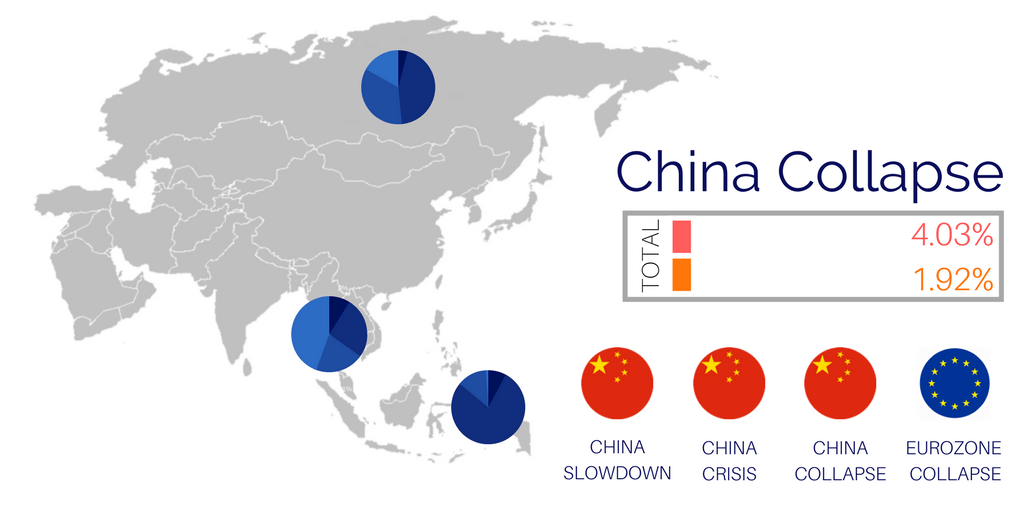

We've launched a Credit Risk Model to help clients assess the effect of political and economic shocks on the risk of corporate defaults and the dollar impact on an insurance or investment company's assets.

The Credit Probable Maximum Loss (PML) model helps leading credit risk underwriters to inform their underwriting strategy by assessing the risks to their entire portfolio, as well as the default probability of an individual company

No two risks in one country are alike. Our credit model is unique in that it uses expert political risk analysis from our team of regional specialists. Contact us to learn more about how our political and economic risk analysis can provide a competitive edge.

AKE's analysis team produces tailored reports and online content on the effects of geopolitical scenarios on the risk of default and non payment, as well as a range of other political, economic and security risks to clients' investment portfolios. Feel free to browse and share free content from our political risk analysis blog.

For further information, please contact us.