We are specialists in providing economic and political risk consultancy. Our intelligence analysts are building on 20 years experience in understanding political risks faced by our clients in insurance and financial services.

We offer a bespoke consultancy solution that directly answers our clients' questions by cutting through the white noise of excess information and news updates that too often drown-out insightful analysis.

At our core is a team of experts dedicated to providing tailored analysis and strategic forecasting, allowing our clients to confidently asses the risk associated with investing in challenging environments and emerging markets.

1. Political Risks

Confiscation, licence cancellation, selective discrimination, regulatory risks

2. Economic Risks

Sovereign / sub-sovereign default, currency inconvertibility, macroeconomic trends

3. Political Violence

Terrorism, civil unrest, labour unrest,internal and external conflict, kidnap and piracy

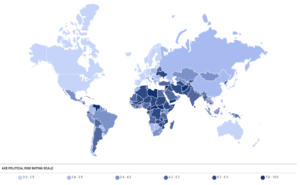

Our political and economic risk services are delivered globally by an experienced team of regional political, security and subject matter experts, as well as regional language specialists.

Contact us to learn more about our experience, and how we help you understand and avoid the business risks faced by your organisation.

Tailored political risk reports

Our analyst team provides tailored political risk reports on the risks to assets, contracts and payments, or high-level country risk and sector overviews

- Physical security risks to assets, including risk of physical damage or business interruption

- Political risk analysis including hostile government action, expropriation of assets, contract cancellation or legal and legislative risks

- Macro-economic risks, sovereign default

- Non-payment risks by sub-sovereign entities

In-house political risk consultants and face-to-face political risk consultancy

AKE embeds highly-qualified political risk specialists in our client's teams to help them assess the risk to their business portfolio, and give them a competitive edge:

- Full or part-time embedded political risk consultants

- Face-to-face political risk consultancy

- Regular briefings and expert economic and political risk insight

- Question and answer sessions

- Telephone advice consultancy

Online political risk analysis platform and credit risk modelling

Our intelligence team provides online country risk platform and credit risk models that help clients assess the political, security and financial risks they face at the touch of a button.

- Global Intake 2.0 - Online country risk analysis platform, including 190 country profiles of live political, economic and security risk analysis

- Credit risk modelling

- Assess the risk of individual defaults

- Measure the dollar impact of political and economic shocks and contagion

AKE's political risk consultants provide tailored analysis and foresight that builds on an understanding of our clients' business. For details, pricing options and to learn more about our approach please contact us.